How much cash do you wish to acquire?

From the Expense, we strive to generate monetary choices with full confidence. While many of one’s items assessed are from our Service providers, including those with and this the audience is associated and people who compensate you, all of our studies should never be dependent on them.

Minimal Availableness. KeyBank also provides home equity money and HELOCs when you look at the fifteen claims plus AK, CO, CT, ID, Inside, MA, Myself, MI, Nyc, OH, Otherwise, PA, UT, VT, otherwise WA.

Really does KeyBank offer domestic guarantee finance and you may HELOCs?

KeyBank has the benefit of one another household equity finance and HELOCs. Both financing try protected by a house, leading them to safer getting loan providers. Ergo, home collateral financial support is some of one’s most affordable offered to customers.

Regarding the KeyBank

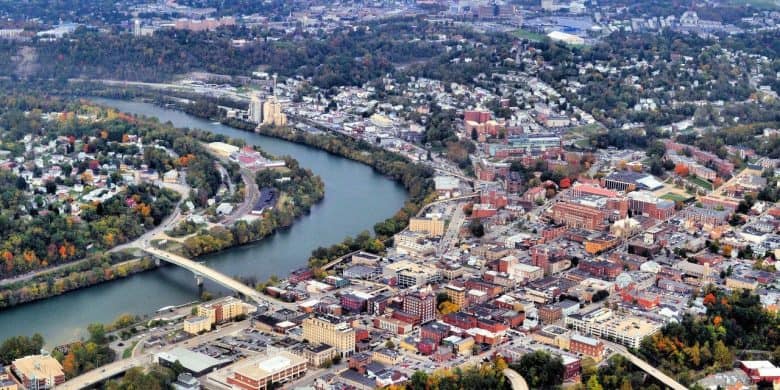

KeyBank is just payday loans Penton one of the country’s oldest and you will prominent banking companies and you can offers alternatives for each other family collateral financing and household collateral traces off borrowing from the bank (HELOCs).

KeyBank dates back 190 years and has more $140 billion in customer places now. That delivers the lending company considerable tips getting credit, and it even offers a wide range of borrowing from the bank points and mortgages, unsecured loans and credit cards.

KeyBank keeps a system of about step 1,000 branches across fifteen says. Additionally, it lets consumers to try to get finance and would its account on line.

KeyBank domestic collateral mortgage

- Restriction loan-to-value: 80%. One payment pertains to the brand new combined overall of all financing shielded because of the assets.

- Rate of interest assortment: 8.18% to %. Along with becoming at the mercy of change-over day, rates offered believe the size and you may period of the brand new loan, the brand new borrower’s place and you may credit score and you will perhaps the mortgage have a first or second allege on assets put due to the fact guarantee.

- Maximum and you may lowest financing amounts: $25,000 so you can $249,999.

- Period of loan terms and conditions: one year to 3 decades.

- Additional features: There was a 0.25% rate of interest disregard getting customers that have good KeyBank discounts otherwise family savings. As well as notice fees, consumers spend a $295 mortgage origination payment.

KeyBank HELOC

- Restriction mortgage-to-value: 80%. One commission applies to the fresh new mutual full of all of the financing covered by assets.

- Interest rate range: 5.75% to eight.00%. As well as getting at the mercy of change over time, rates believe how big the newest personal line of credit, the latest borrower’s area and you can credit score and you may if the loan have a first or secondary allege to the possessions used since the collateral.

- Limitation and you will lowest financing amounts: $ten,000 so you can $five-hundred,000

How-to submit an application for KeyBank house collateral money

Interested borrowers can put on for property collateral mortgage otherwise HELOC on line otherwise any kind of time KeyBank part place. This new KeyBank webpages states the applying processes would be completed in below ten minutes.

To get started, candidates should provide basic personality, money, obligations, a career and advantage guidance and you may identify the house or property they are going to explore because the equity. They will certainly must establish the label as well.

KeyBank gives the assistance of faithful benefits to resolve questions relating to house equity loans or HELOCs. The positives may also help guide individuals from software procedure.

KeyBank provides a button Economic Fitness Feedback having potential individuals which need larger suggestions. This will be a scheduled appointment having an experienced banker that will let consumers learn its financial situation ahead of it sign up for credit.

KeyBank professional and you may individual recommendations

Expenses featured 7 more user financing remark internet sites and discovered evaluations getting KeyBank’s house equity credit on the merely two of them. The common ones a few feedback is actually step 3.seven of 5 celebs.

Trustpilot gave KeyBank a 2.0 away from 5 get. However, brand new forty-eight feedback mostly alarmed the ATMs and you will were not specific so you’re able to KeyBank’s family equity lending products or service.

The better Company Bureau (BBB) gave KeyBank a the+ get, while the financial is not licensed from the Better business bureau.

KeyBank positives

While many loan providers enjoys deserted otherwise limited house collateral items in modern times, KeyBank nevertheless also provides HELOCs and you can a range of house security financing.

KeyBank now offers consumers the option of banking individually or implementing for a loan online. Their site was well-organized and you can makes details of its financing factors easy to find.

While you are HELOCs are apt to have adjustable rates of interest, KeyBank’s HELOCs bring individuals the ability to protect (fix) a performance whenever attracting money contrary to the credit line. Locking a speed causes it to be easier for a borrower in order to budget the money.

KeyBank Drawbacks

Possible individuals might be sure to notice the latest costs for the KeyBank’s domestic security issues. There is certainly an effective $295 origination payment towards the family security money. The fresh new HELOC costs an excellent $fifty yearly percentage getting keeping the new personal line of credit.

The necessity of these types of costs are evaluated about perspective of almost every other terms and conditions given on fund. A reduced interest along side life of that loan you will offset the cost of charge.

Because of the annual fee to the HELOC, the cost-functionality of this tool would depend regarding how their interest rate compares with that out of other solutions, as well as on how greatly this new borrower intends to make use of the range out-of borrowing.