Your house guarantee otherwise 2nd financial appraisal is used getting loans consolidations, guarantee bucks outs, home improvement money, and you will house refinances. With these reports, interior monitors try completed and you can specifications is actually drawn. Brand new variations used are generally FNMA 1004, 2055, 2065, otherwise FHLMC 704

Which assessment is usually employed for financing out of single-family relations dwelling orders as well as for domestic refinances. Brand new report’s improvement grid measures up the new comparable conversion toward topic property. This comparison shows specific buck improvements, thus making it possible for brand new are accountable to give a particular conveyed market price. The newest declaration contains about three-users that can easily be accomplished since the an area just examination or once the an interior and you will additional examination.

Desktop Underwriter Quantitative Study Report (FNMA 2065)

This is a mortgage appraisal which can be used to possess refinancing an individual-family dwelling and a house security loan. The brand new report shows an assessment of your topic when it comes to premium, equivalent, inferior, no unmarried market value considering. A bad relationship is shown throughout the report’s modifications grid when the brand new comparable is preferable to the subject.

Empty Belongings Appraisal

The fresh new Homes Appraisal Report is actually a detailed that-web page report out of bare property only. It refers to the niche property, neighborhood, and you may website. Industry Data Analysis brings a summary of equivalent sales to have the topic. The fresh Reconciliation provides the shown market value of your website.

Drive-of the Appraisal Report

A force-from the appraisal may be used from the lenders if you have an effective range about property’s worth plus the amount borrowed, family refinances, home guarantee funds, along with https://elitecashadvance.com/installment-loans-sc/ certain next mortgages. Since these appraisals do not require an inside inspection or dimensions, particular data is necessary regarding assets in advance of doing the fresh statement. The latest models utilized could be the Advantage Assessment, FNMA 2065, FNMA 2055, or FHLM 704.

Multi-Family relations (Residential Income-Producing) Assessment Statement

The fresh new appraisal declaration are used for a multiple-loved ones dwelling where the earnings being introduced is employed to own provided the market price. The small Residential Earnings Possessions Appraisal Declaration, which is also known as Fannie mae Setting 1025, is used doing such assessment. It is a four-webpage claim that usually has maps, floor preparations, and you will picture attachments.

Relocation Assessment

The fresh Personnel Relocation Council Residential Appraisal Report, or ERC, is employed when a worker regarding a national organization is animated, to get, otherwise promoting a house. It is a half a dozen-web page declare that needs competitive posts, comparable transformation, maps, flooring preparations, and you can picture parts.

Foreclosure/REO Valuations

Whenever choosing the newest marketability regarding a property, a foreclosures valuation can be utilized. An area review is carried out, then when possible, an inside inspection is done. One or two conclusions should be install regarding the review, an as well as or subject to fixes. In the event the susceptible to solutions ‘s the conclusion, up coming a list of necessary solutions in addition to their costs are provided. An enthusiastic URAR, referred to as FNMA 1004, is used to possess REO valuations in addition to appropriate parts.

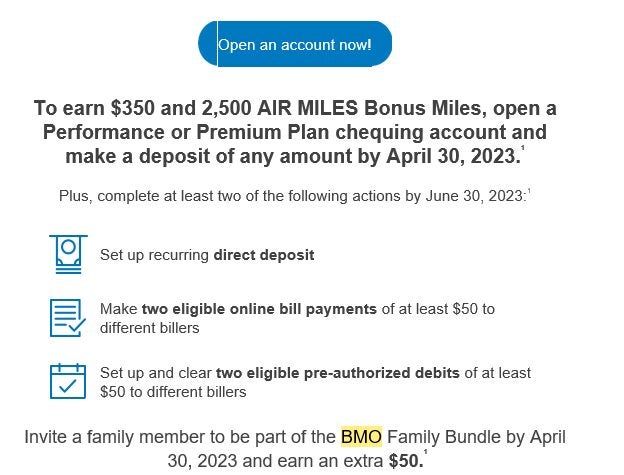

On the web Financial, Mobile Banking and PhoneONE could well be unavailable regarding p.meters. into the Weekend, Oct six to help you dos:00 an excellent.meters. Monday, Oct seven, while we carry out regime system restoration. We apologize for all the inconvenience this could lead to and take pleasure in your persistence.

Stay away from Scammers! Scammers is generally posing just like the CommonWealth One to just be sure to discount your own advice otherwise difficult-made money. Stay vigilant and not show your account facts and private information. Follow this link for additional information on protecting yourself out of ripoff.

- Borrow doing 100% of the house’s guarantee (LTV ? )

- Mortgage numbers out-of $ten,000 in order to $five hundred,000*

- Lowest repaired rate

- Installment terms as much as 20 years

- Use doing 100% of your home’s collateral (LTV ? ) with regards to to purchase a property