Will you be fantasizing off owning a home but concerned with the newest economic difficulties? A great USDA mortgage may be the answer you’re looking for. This type of fund, backed by the usa Agencies off Agriculture, promote a separate path so you can homeownership with attractive advantages such as for example zero downpayment and flexible borrowing from the bank conditions.

Exactly what could be the conditions for a good USDA Financing? This guide will take you step-by-step through everything you need to discover to meet the requirements in 2024, out-of earnings limits and you will credit score criteria to assets qualification and you can the application form process.

Whether you’re a primary-go out homebuyer or trying to upgrade your current residence, understanding the ins and outs of USDA Financing makes it possible to and work out told conclusion and achieve your homeownership specifications.

As to why Choose a beneficial USDA Loan? An instant Look at the Pros

USDA Financing provide a different sort of combination of experts, leading them to a nice-looking choice for many homeowners, especially those inside particular, qualified section. Particular key gurus is:

- Zero Down-payment : Leave behind the responsibility off preserving to have a massive down payment.

- Competitive Rates : Enjoy potentially down rates compared to the Antique Loans .

- Flexible Credit Standards : Even after imperfect credit, you may still meet the requirements.

- Straight down Mortgage Insurance rates : USDA Fund has actually lower verify costs than just FHA Funds .

Getting a further look into these types of benefits (plus), make sure you check out our very own complete book, The latest 8 Secret Benefits associated with USDA Finance .

That has Qualified? Borrower Criteria having a beneficial USDA Loan for the 2024

Being qualified to own good USDA Loan relates to meeting particular criteria place of the the us Department of Agriculture . Why don’t we break apart what you need availableloan.net 10000 loan guaranteed approval to discover:

Location: USDA Financial Home Conditions

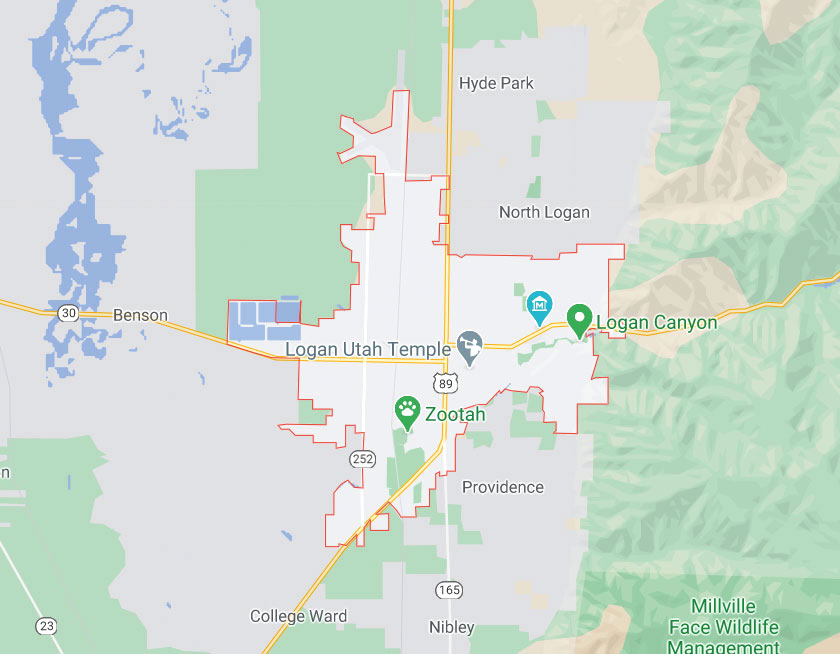

We’ll break down the house conditions in more detail after, but also for today, you will need to discover what is actually created because of the rural. The expression outlying area might conjure upwards pictures out of sprawling farmland, nevertheless USDA’s meaning is actually somewhat broad. In reality, many suburban parts plus some quicker locations be eligible for USDA Loans. This is because this new USDA takes into account society thickness, not simply place when designating qualified parts.

To make certain your ideal house qualifies, an informed strategy is to apply our USDA entertaining qualifications map. That it affiliate-amicable tool allows you to get into a message or zoom when you look at the towards the a specific destination to see if they falls within this a good USDA-appointed outlying urban area. Alternatively, you could consult with financing Manager who is experienced with USDA Finance. They’re able to accessibility new qualifications studies and you can confirm in the event your fantasy possessions fits the region standards.

Income Limitations: Exactly what are the Requirements for an excellent USDA Loan regarding Income?

USDA Fund are created to create homeownership accessible to low- and moderate-money family located in certain elements. So you’re able to meet the requirements, your own complete domestic income try not to meet or exceed 115% of your city median income (AMI). The fresh AMI is actually an analytical way of measuring the average overall money earned because of the all of the family members in the a particular geographic area. With this particular metric, the USDA assures its financing applications is actually directed for the domiciles needing all of them really.

You can check your own area’s money restrictions using the interactive USDA money qualification product . Click the state you are interested in, and you might get insights towards various other income accounts for everything out-of solitary-individual domiciles to family having 8+ participants!

The new 115% factor will bring particular autonomy, making it possible for alot more families so you can qualify. not, it’s important to observe that the money limitation for your condition varies according to dos key factors:

- Area : Money limitations will vary a lot more by the geographic place. Rural elements that have increased cost-of-living will provides highest earnings limits than just parts having a reduced cost-of-living.