Danger of foreclosures: One to extremely important downside away from a home security financing is that it throws your home at risk

3. Lower Down Payment Requirements: Construction loans often have lower down payment requirements compared http://cashadvanceamerica.net/personal-loans-pa/ to traditional mortgages or home equity loans. While conventional mortgages typically require a down payment of 20% or more, some construction loans may only require 10% or even less. This lower initially funding can be advantageous for homeowners who may not have substantial savings or equity in their current property.

Access to large sums of money: One significant advantage out-of a property equity financing is that it lets residents in order to use good quantities of currency according to research by the security he has accumulated within possessions

As an instance, should you decide to build an inclusion for the current house, a houses loan having a diminished downpayment requisite can make your panels even more financially possible. This allows that maintain your own coupons for other costs or opportunities.

4. Designed Financing Terms and conditions: Structure money bring autonomy regarding financing duration and you may payment choice. Because loan is specifically designed to own build motives, loan providers usually render personalized terms and conditions you to make towards project schedule. Including, for folks who greeting completing the construction within this a-year, you could potentially opt

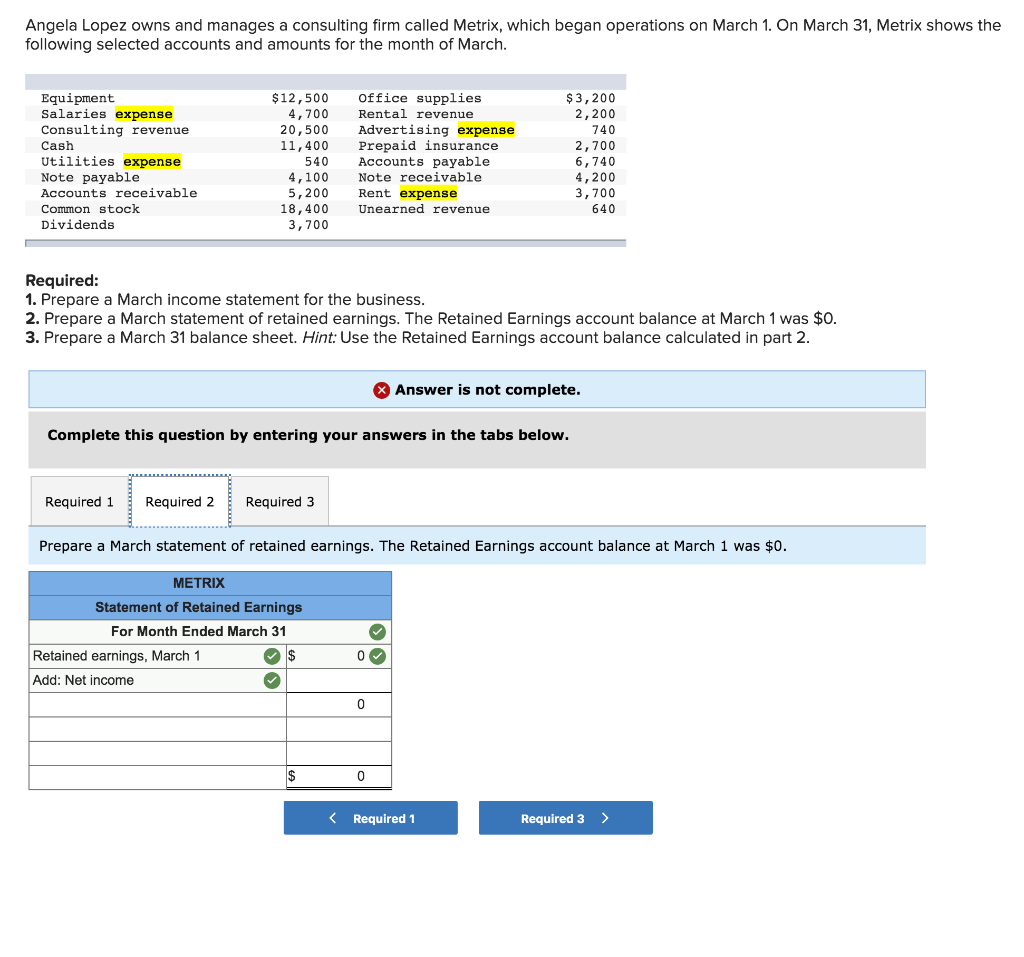

Weighing the advantages and you can disadvantages off domestic collateral fund are a keen essential step up deciding whether these types of financing is the correct one for you. Household guarantee loans might be an important financial device having property owners seeking availability loans for different motives, like domestic home improvements, debt consolidation reduction, otherwise significant expenses. However, it is important to carefully imagine both the advantages and disadvantages before deciding.

step one. This is certainly such helpful whenever undertaking significant framework plans you to want a substantial money. Such as, if you plan to construct an improvement to your home otherwise renovate your kitchen, a property guarantee mortgage also have the desired funds.

2. Lower interest rates: Home equity loans often come with lower interest rates compared to other types of loans, such as unsecured loans otherwise borrowing from the bank cards. Since these loans are secured by your property’s value, lenders consider them less risky and offer more good interest levels. This can result in significant savings over time, especially when borrowing larger sums of money for construction purposes.

step 3. Income tax professionals: In some cases, the eye paid down to the a house collateral financing are tax-deductible. This will give extra economic professionals having homeowners, cutting its overall income tax accountability. However, it is vital to consult an income tax elite knowing the tax effects considering your own personal situations.

cuatro. If you can’t generate prompt money toward financing, you might face foreclosure and you can beat your home. It is vital to carefully determine your capability to repay the financing before you take on this subject obligations.

5. More debt obligations: taking right out a home collateral loan mode including a different sort of financial obligation obligations at the top of your existing mortgage. This can boost your monthly economic duties and potentially filter systems your budget. It is very important to consider whether you can easily carry out the additional loan payments instead decreasing your current economic balances.

6. Closing costs and fees: Like any other loan, home equity loans come with closing costs and fees that need to be factored into the decision-while making procedure. These costs can include appraisal fees, origination fees, title search fees, and more. It is important to understand the full cost of obtaining a home equity loan and examine they with other investment choice.

Weigh the pros and Cons of Family Guarantee Finance – Framework Loan versus: House Collateral Financing: Which is Effectively for you