Simply how much Carry out Mortgage brokers Generate From your own Mortgage?

There may be chance-created surcharges for these with lower credit ratings, small off costs, or riskier attributes such as for instance highest-rise apartments or are manufactured homes.

Additionally, you will find usually expenses to possess 3rd party services such as family appraisals, label insurance policies, escrow officials and you loan places Oxnard can domestic examination.

If you were to think as if individuals are and make a huge amount of funds from your home purchase otherwise re-finance, it’s understandable.

Lending company Costs

Brand new slew of brand new financial rules and you can individual protections, when you are generally considered to be an optimistic issue to your globe, did increase lender will cost you. Banking institutions, brokerages and you will non-financial originators implemented the brand new strategies and you can hired so much more teams in order to comply with this new laws.

Debra However, Chairman out of Pulte Home loan, claimed into the a recent speech that into the 2006, the common mortgage file got 302 pages. Now, the common mortgage file (publication?) was 806 profiles.

So it was the cause of cost of originating an alternate home loan so you can increase by the normally $210, boosting the complete costs to around $eight,700 for each and every financial.

Lending company Winnings

Towards the end out of 2015, speaing frankly about increased regulation, staff will set you back, and financing purchase-backs (foreclosure, an such like.) had fell lenders’ for each-loan cash, with regards to the Financial Bankers Organization (MBA), so you can $493 for every single financing.

Although not, as loan providers improved on dealing with the new guidelines, and brought in the fresh new technology, will cost you emerged down again and you can earnings flower – so you can an average of $step one,686 for every single mortgage in the next one-fourth regarding 2016.

There clearly was without a doubt money on the desk when shopping for home financing. But that cash was according to the lender’s manage, perhaps not the loan agent’s.

Financing Officer Income

Depending on the Us Agency regarding Labor Statistics (BLS), brand new average shell out from inside the 2015 getting loan officials of all the groups – commercial, individual, and home loan – are $63,430 annually. A reduced 10% attained less than $thirty two,870, while the higher 10 % received more than $130,630.

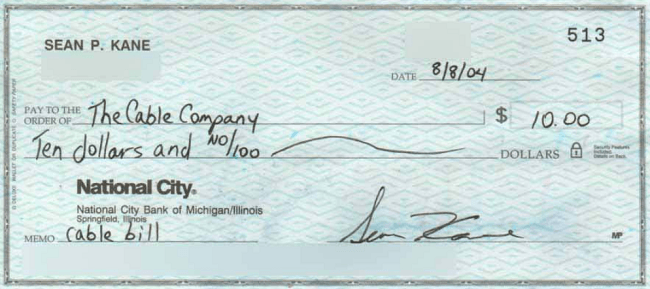

Financing broker settlement varies commonly. Certain found a flat income, but the majority are repaid towards payment. The fresh poll show below from inside Financial Financing tell you the number out of profits paid off. For each and every basis area was step 1/100th of just one per cent, therefore 25 foundation facts, otherwise bps, means step one/cuatro of a single %. That is $250 having an effective $100,000 financial.

Working for Free

Very real estate loan gurus run payment. That means they might spend era to work out mortgage scenarios to you personally, help you replace your credit score, remove their requisite documents together, over your application, acquisition title account and you may verify the employment, assets or any other appropriate information.

They won’t usually receive money if you decide to not ever purchase or re-finance, and/or application is denied, or if you transform loan providers. Doing work for 100 % free is a huge section of this business.

Mortgage Earnings

Income will vary between finance companies, broker agents and you will originators. What is banned, yet not, is that the commission to suit your loan depend on the brand new terms of the mortgage – zero incentives getting giving you a high rate, or bigger commission, without punishment having reducing you a cost savings.

If the financing representatives want your business, they will certainly give you a knowledgeable contract welcome because of the the manager the borrowed funds lender or brokerage.

Just how to Discuss A knowledgeable Mortgage Rates

While shopping for home financing, compare also provides away from various other fighting loan providers. There isn’t constantly much are attained by the functioning over an enthusiastic individual mortgage officer and trying defeat a far greater contract aside off your ex.

But not, lenders is actually barely permitted to lower your costs somewhat (deviate, as the saying goes in the industry) under certain criteria. They are permitted to get it done so you’re able to participate having a special lender’s cost, whether they have an insurance policy set up that fits recommendations centered because of the Individual Economic Safeguards Agency.

Next, people disregard can not be taken from the mortgage manager percentage, except to defray specific unexpected grows when you look at the estimated settlement costs.

Just what are The present Financial Pricing?

Today’s costs believe financial show, coverage, wanted profit margins or other issues. It just does not matter exactly what a lender’s procedures is actually otherwise how much its smart their mortgage agencies. What matters ‘s the conclusion offer it offers your.