1. Virtual assistant Loan Education

Jimmy, getting an experienced themselves, knows personal the necessity of comprehensive education into the Va finance. The guy has the benefit of a personalized method to give an explanation for process, making certain their fellow pros and you can active-obligations professionals have all training they should generate advised behavior.

dos. Pre-qualification Advice

That have many years of sense, Jimmy knows how to look at a beneficial borrower’s economic stance accurately. The guy brings invaluable suggestions about just how veterans can be status by themselves most useful before software to optimize its financing prospective.

step 3. Document Preparation and Range

Jimmy’s knowledge of the latest army records, combined with their deep experience with Va mortgage criteria, means all the documentation was careful. Their team’s reliability boosts the new recognition techniques.

cuatro. Financing Alteration

Jimmy’s personal experience while the an experienced lets your so you’re able to resonate which have the unique needs off army household. Because of the experiencing which, he can modify mortgage possibilities you to certainly complement personal circumstances.

5. App Entry

That have processed countless Virtual assistant loan requests, Jimmy has a proficient comprehension of possible issues. The guy very carefully product reviews the software to eliminate people missteps, ensuring smooth sailing from the underwriting stage.

6. Liaising having Underwriters

Their longstanding matchmaking that have underwriters allow effective interaction. If any inquiries happen, Jimmy’s connection assurances they’ve been handled swiftly, to prevent so many waits.

7. Addressing Credit Products

Understanding the challenges some veterans deal with blog post-solution, Jimmy provides compassionate and you may practical advice on approaching borrowing from the bank affairs, leveraging their detailed sense to give solutions that most other agents you will neglect..

8. Va Appraisal Procedure

Jimmy means that veterans are not blindsided because of the property products. By the matching the brand new Va assessment procedure, he confirms your possessions not merely match Virtual assistant requirements but plus caters to an informed passions of experienced.

9. Clarifying Financing Requirements

Which have a partnership to help you quality, Jimmy deciphers state-of-the-art financing standards to own borrowers, making certain they truly are satisfied punctually. His proactive approach decreases the potential for last-second surprises.

ten. Negotiating Prices and you may Conditions

Jimmy’s reputation and assistance condition your as a formidable negotiator. He ardently advocates to possess their readers, guaranteeing it get the most beneficial rates and you can terminology.

11. Streamlining the brand new Closing Processes

With wandered plenty of veterans to their homeownership fantasies, Jimmy knows the importance of a softer closing. He orchestrates the past measures meticulously, making certain every detail is actually place for a profitable conclusion.

Having a good Va mortgage large financial company like Jimmy Vercellino, whom focuses on Virtual assistant financing, implies that borrowers enjoy the novel great things about the application form while navigating the complexities out-of underwriting. Their assistance brings a barrier against possible hiccups, making sure the path so you’re able to homeownership can be as smooth as possible to own veterans and you will active-duty military users.

The brand new underwriting procedure to possess Va funds is a serious stage that identifies whether a software would-be accepted, and at just what conditions. It involves numerous secret methods:

- Pre-qualification: In advance of dive strong to the underwriting techniques, loan providers generally take a look at a potential borrower’s financial position to provide good crude estimate of your own amount borrowed you to you are going to qualify for.

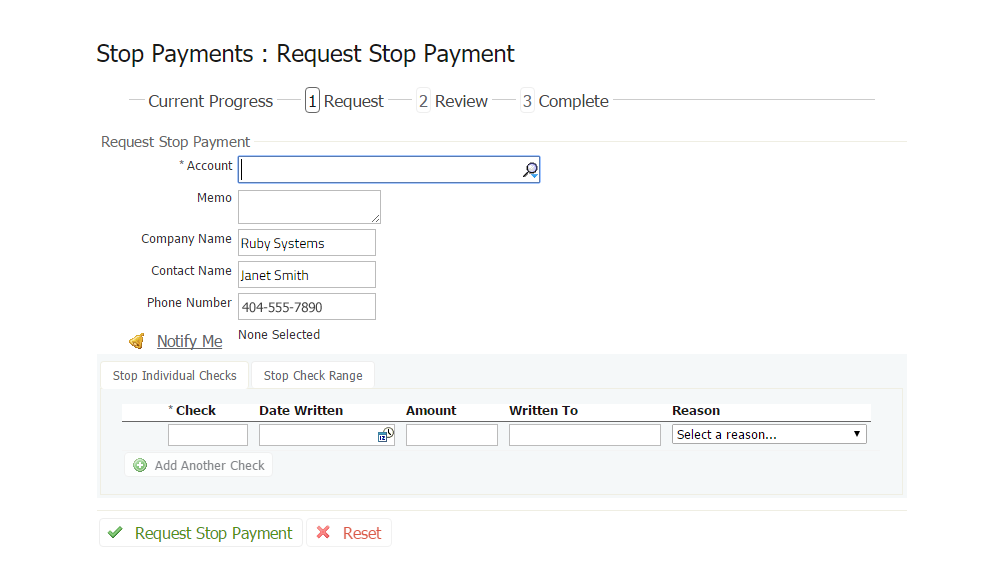

- Application for the loan: The borrower submits an in depth application providing most of the necessary economic guidance, and additionally money, debts, and you will assets.

- File Collection: The financial institution accumulates crucial documents such as spend stubs, taxation statements, financial comments, and americash loans Dauphin Island other associated files to verify new borrower’s finances.

- Va Assessment: Unique so you can Va loans, an appraisal is bought to evaluate this new property’s worth and ensure it match Virtual assistant minimal assets standards. That it covers the fresh seasoned buyer from to acquire a sub-practical possessions.

- Borrowing Review: Loan providers opinion the latest borrower’s credit file to evaluate creditworthiness, percentage history, and you may total monetary conclusion. Virtual assistant money generally have a great deal more lenient credit requirements versus almost every other loan systems.