Realize about trick work attributes and you may experience having mortgage processors.

If you’ve ever removed financing of any sort, you have caused a loyal monetary top-notch called that loan processor chip – perhaps without knowing it! But what exactly do that loan chip perform? That will which job profession feel a good fit to you?

Whether you’re a skilled mortgage professional seeking a distinction or the to your home loan world, check out what you want to know about the fresh character, a number of of good use knowledge, and many of important requirements for a financial loan running career path.

What is actually a mortgage Processor chip Responsible for Undertaking?

An interest rate processor chip (LP) ‘s the middleman amongst the financial in addition to borrower. It gamble a switch role in guiding applications across the finishing line. Listed here is a closer look in the its regular workflow, at all times:

A mortgage loan Processor’s Occupations: On Application

Whenever a mortgage application is available in, the new processor will start preparing they to the underwriter. Underwriters is house money experts who be certain that borrower recommendations that assist see whether they shall be acknowledged towards loan. Very, safe to express customers should lay their very best base submit. This is when the latest chip is available in.

New LP contains the crucial character off making certain the brand new borrower provides all of the necessary documents, together with income suggestions, a position verification, financial comments, and more. Might after that work to make certain all of that information. This could become research such as for instance checking on the new borrower’s a career condition and you will confirming its social protection number.

The task also contains organizing the borrower’s pointers so the underwriter can certainly get a hold of and you may accessibility the required documents. When you look at the doing so, they could promote a definite and you may uniform story to the underwriter to your borrower’s money, costs, target, credit rating, and.

An interest rate Processor’s Business: In the Approval Process

As acceptance techniques moves on, the new LP acts as a chance-anywhere between with the debtor and you can financial. They followup for the any requests regarding underwriter for additional information, bring borrower causes, and you can locate people shed paperwork.

The newest LP and additionally commands the 3rd-cluster qualities, regarding term so you’re able to appraisals, and ensures all the people interact with the piece of the deal puzzle, all-in returning to a soft closure.

A mortgage loan Processor’s Occupations: Closure and you may Past

As latest acceptance is actually provided, the LP upcoming works closely with new title providers to assists the newest balancing of your own final numbers. Nevertheless they strive to agenda the state closing when the borrower signs to the dotted range therefore the household technically becomes theirs.

So far, the brand new LP’s efforts are fundamentally complete! They will begin the whole techniques once again with a new visitors.

Exactly what Experiences You’ll a processor chip Desire?

Like most job, particular skills become more suited to home loan control as opposed to others. That being said, there’s no reasoning you simply cannot grow otherwise cultivate the abilities needed to progress.

Focus on outline. LPs juggle of many customers, data files, and you can info. They cannot manage to provides something slip through the cracks. Anyway, even you to mistake you can expect to lose the whole contract!

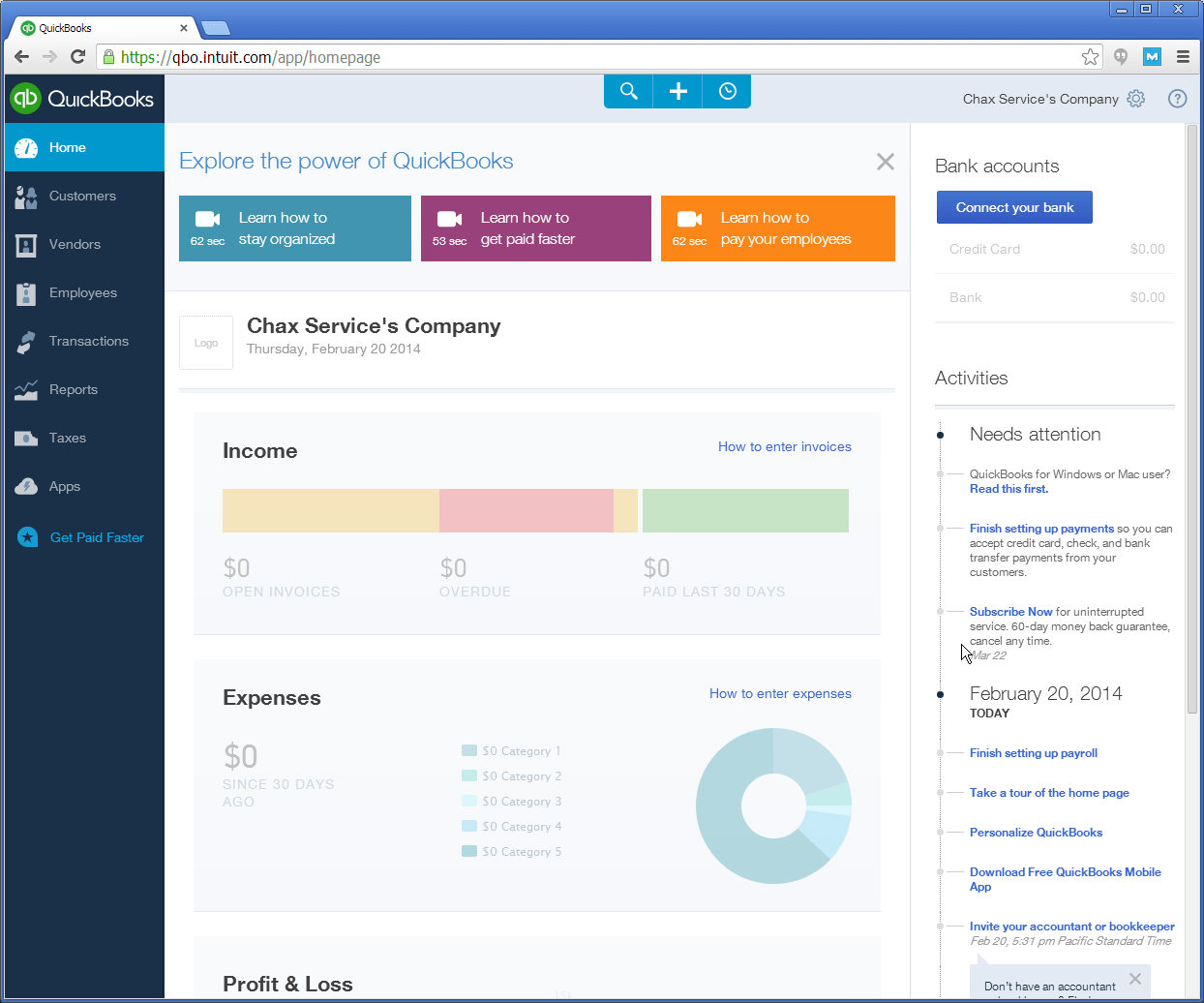

A leading standard of providers. LPs work at various document products and you may do communication away from numerous stakeholders for hours personal loans in Philadelphia with bad credit on end, daily. An effective submitting program, a straightforward-to-have fun with dash, or even higher notice-delivering show can help remain LPs organized as well as on song.

Higher level communications. To achieve which field, you need good interaction enjoy, in writing and verbally. Think about, LPs is essentially middlemen! You’re going to be into the ongoing experience of numerous readers, home loan originators, and you may underwriters.

Obviously, there are a lot a lot more qualities which could give you a beneficial mortgage chip. This type of just give a leaping-of area.

While eager to find out more, maybe believe effortless-to-fool around with dashboard with or shadowing an area chip. You can see just how the identity ties in into employment and you will help determine if this community could well be a fit for your, also.

What are the Studies or Training Criteria?

Real estate loan processors will most likely you desire a senior school diploma, and many companies need a great bachelor’s degree within the an area such as for instance funds otherwise accounting. Knowledge qualification applications arrive, but some employers supply to the-the-employment degree.

Of numerous mortgage processors will start out-of as loan administrator personnel otherwise mortgage running personnel to get experience, however, experience with one a portion of the exchange procedure is effective. For example, if perhaps you were a name team processor chip otherwise document specialist for a loan upkeep organization, their feel you may translate well so you can home mortgage handling.

Happy to Initiate Your career as the an interest rate Processor?

Thus, do a job within the home loan running sound right to you personally? That it industry is quick-paced but satisfying, and there is plenty of room to own beginners.

Seeking have the hottest home loan knowledge introduced to their email? Sign up for wemlo newsletter where you can find the fresh business and you may mortgage styles everything in one set.